Get Total & Permanent Disability Insurance

Total & Permanent Disability (TPD) Insurance provides financial protection in the event of a severe disability that prevents you from ever working again. It offers a lump sum payout to cover medical expenses, ongoing living costs, and necessary lifestyle adjustments. TPD Insurance ensures that you and your family are financially secure during challenging times, allowing you to focus on recovery and maintaining your quality of life. Safeguard your future with Aspect’s reliable TPD Insurance coverage.

Request a quote & purchase it within 10 minutes on the go.

Financial assistance for you & family for when you need it the most.

Insure a sum you want. We cover sums up to $1,000,000

Need More Information?

If you are unsure or require more information please don’t hesitate to

contact us or read our PDS

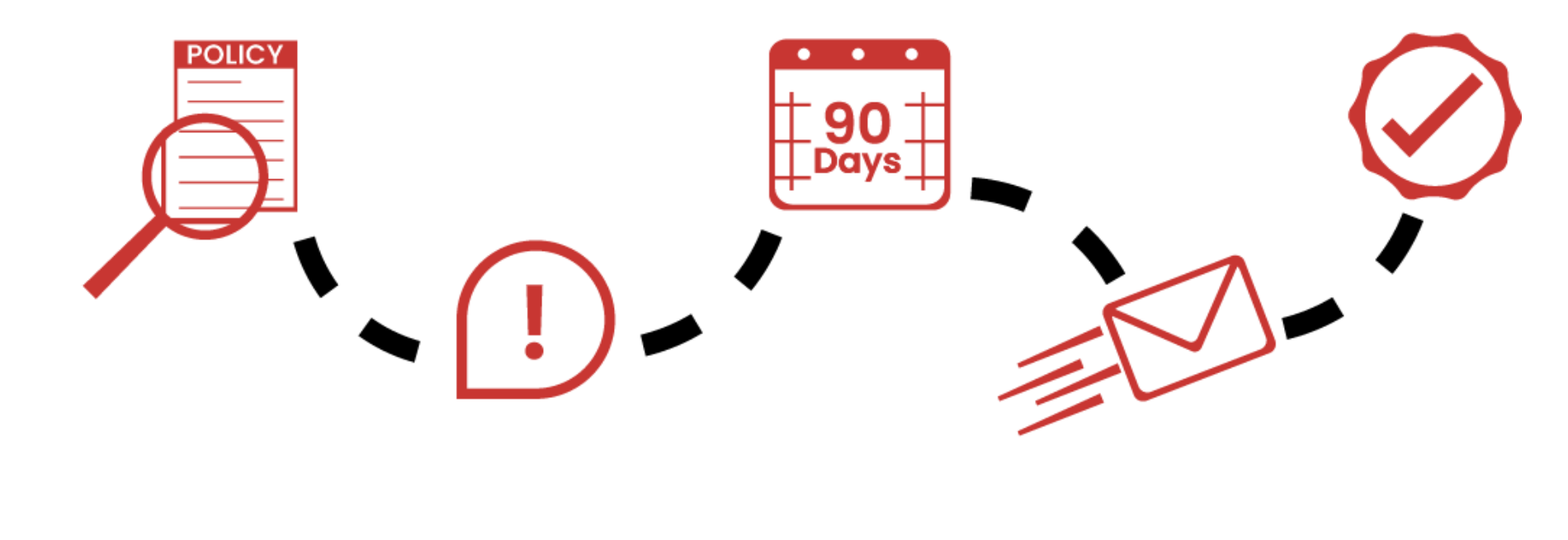

Our Claim Process

Check your policy & cover before making a claim.

Provide proof of claim.

We communicate to you once claim has been processed.

Provide notice to us as soon as reasonably practicable of any injury or illness.

Submit your claim form and supporting documents.

Get In Touch

Find out more about how Aspect Underwriting can assist you with your client’s Accident & Health policy needs and London market placements. if you have a specific inquiry please use our full contact form here.